Closing Strategic Gap

Product Innovation

After

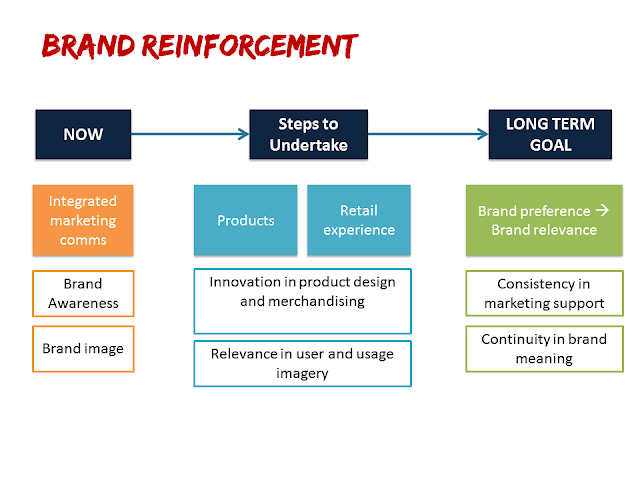

closing the tactical gap, we came up with several future growth strategies for

Denizen in terms of product innovation, improving retail experience and improve

communication to close the strategic gap.

Product Innovation

Based on our survey results, consumers

perceived Denizen to have limited product offerings and designs. As such,

Denizen should improve and increase its product offerings and designs to

attract its desired target consumers. Riding on the Korean and Japanese trend,

Denizen will engage dedicated design team to update their designs of tees

regularly and seek collaboration with celebrity designers to launch trendy designs to entice the youth to purchase Denizen products.

Improving Retail Experience

Photo Booth

To make the retail experience more

exciting and to help Denizen attract the correct target group (a younger

crowd), we would set up a

photo booth in selected stores.

After

trying on the jeans, consumers can choose to take photos in the store. Thereafter, we would display the photos in a

LCD TV in the store. We would also be posting the photos on Facebook

after obtaining their approval to drive traffic to our Facebook. To goal is to enhance the overall retail experience by evoking more excitement to allow the

customers to stay in the store for a longer period of time. This would

encourage them to make a purchase eventually.

Mobile Application

(1)Body

shape Analysis:

Part

of the retail experience would be the use of this mobile app to help

analyze customers body shape. This would be to help consumers find the right fit

and to bring across Denizen’s focus on Asian cuts.

(2)

Catalogue of latest collection:

This

would be to help create a virtual retail experience to engage the

consumers continuously. This can also serve as a platform to reach out to the consumers

regarding the latest product launches and offerings.

Customer Service

To complement the retail experience,

customer service is one of the important touch points. Training has to be

provided for all retail staff in areas such as offering professional recommendations for

jeans and other apparel. Denizen will seek to achieve the Service Excellence Award by SPRING Singapore in the next 5 years to come.

Improving Communications

To

assist Denizen in improving the products and services, it is important seek feedback from the consumers through continuous engagement. This can be done

through the various online platforms that she has. For instance, with the

launch of Denizen Singapore Facebook page, it would be easier for the local team to

make use of this platform to gather opinions from the Singapore market.